Key Highlights

33.6%

Gross IRR

₹ 720 Cr

EMV or Exit Value

Acquisition Overview

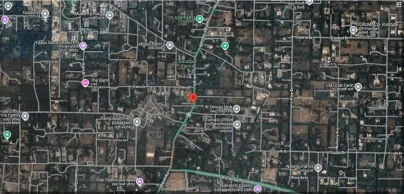

This project involved the acquisition of a distressed industrial property in Greater Noida, spanning 270,201 sqm, through an NCLT auction. The property presented a significant opportunity for a value-add turnaround. Post-acquisition, the site was developed into a modern warehouse and logistics park, catering to major tenants and offering state-of-the-art facilities for efficient operations. The transformation of this industrial property provided a solid foundation for high-income returns through strategic leasing.

Key Highlights

35.1%

Gross IRR

₹ 115 Cr

EMV or Exit Value

Acquisition Overview

The case study involves the resolution of real estate and plant & machinery (P&M) assets of Harig Crankshaft Ltd., a public listed company that was under the Corporate Insolvency Resolution Process (CIRP). The company, which was defunct at the time of acquisition, owned a factory in Noida Phase-II, with an area of approximately 22,300 Sq. Mts. The assets were acquired through the purchase of the majority SRs (Special Resolution) via an Asset Reconstruction Company (ARC), giving us full control of over 95% of the company's shares. Post-acquisition, the focus was on effectively managing the economic deal structure, meeting capital requirements, and smoothly processing the liquidation compliance. Additionally, we successfully lined up buyer interest for the assets before they were officially out for sale, ensuring a timely and profitable exit.

Key Highlights

30.2%

Gross IRR

₹ 37.7 Cr

EMV or Exit Value

Acquisition Overview

This project involved transforming a dilapidated heritage retail space located near Qutub Minar into a premium Grade A retail store. Acquired with no existing tenants, the space was reimagined by maintaining the heritage exterior while completely overhauling the interior to increase its commercial value and attract high-end tenants. The redevelopment was executed effectively, with the added benefit of the high footfall in the area, which contributed to transforming the space into a prominent fashion retail destination.

Key Highlights

43.5%

Gross IRR

₹ 40 Cr

EMV or Exit Value

Acquisition Overview

Key Highlights

33.7%

Gross IRR

₹ 39.2 Cr

EMV or Exit Value

Acquisition Overview

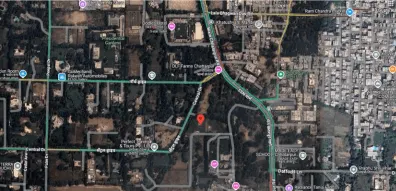

This case study highlights the strategic acquisition and value maximization of a land parcel in Chhatarpur, Delhi, near DLF Farms and Presidential Gardens. The land was acquired through distressed takeovers, with strategic additions from multiple buyers over 1.5 years. The consortium was secured at attractive prices, and through dominant ownership and eliminating local competition, we were able to command higher prices for the land. With active monitoring of real estate activity and pricing in the area, the project ensured target returns while transforming the land parcel into a sought-after asset in the market.